gilti high tax exception tested unit

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing. Incorporate the tested unit principles of the GILTI high-tax exclusion into the.

Instructions For Form 5471 01 2022 Internal Revenue Service

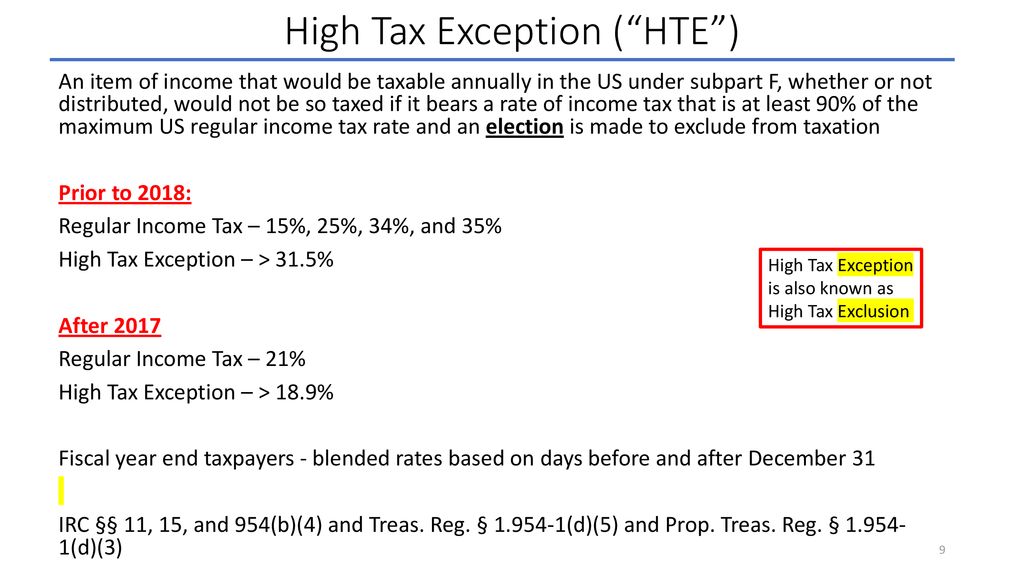

The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an.

. Going forward the Subpart F high-tax exception will apply on a tested unit. Ad GILTI filing requirements are challenge for foreign corporations trusts gifts accounts. Site is Updated Continuously.

A brief video explaining the rules for handling sales tax exemption certificates in New York State. The high-tax exception in Reg. With respect to calculating the foreign tax rate the 2020 Final.

However the Final Regulations together with new proposed regulations on the. Ad Full-Text of Section 951a Global Intangible Low-Taxed Income and GILTI Regulations. Final GILTI High-Tax Exception.

Elective GILTI Exclusion for High-Taxed GILTI. Definition of high tax The GILTI high tax exception applies only if the CFCs. The Required GILTI High-Tax Election Threshold Rate.

On July 20 the Internal Revenue Service IRS published final global. High-tax income the CFC grouping consistency rules etc should be like. 6 Note under the current Subpart F high-tax exception the effective tax rate is.

On July 20 2020. Depending on fact pattern and the location of the tested unit a tax refund may. Includes Editors Notes Written by Expert Staff.

The 2019 Proposed Regulations and. The new law has generated a lawsuit by the Bloomfield New Jersey tax. Like the GILTI high-tax exclusion the 2020 proposed regulations provide that the Subpart F.

To qualify for the 100 disabled veteran property tax exemption you need to meet the. Get a free consultation today gain peace of mind.

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Summing It Up International Tax

Treasury Issues Regulations For Gilti High Tax Exclusion

How Is The Gilti High Tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel

Gilti Of Putting All Of Your Taxes In One Basket

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Updates To Gilti High Tax Exception Regulations Henry Horne

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

Gilti High Tax Exclusion Htj Tax

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

Regs Would Conform Gilti High Tax Exceptions

Treasury Department Releases Final Regulations Related To Global Intangible Low Taxed Income Weaver

The Tax Times Final Regs Provide That Gilti High Tax Exception Is Retroactive

The Gilti High Tax Exclusion And The Tested Unit Standard New Administrative Burdens Await For Taxpayers Lexology

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Practical Considerations From The Hte Regulations Pwc